Master Personal Finance Through Real Practice

Our structured program takes you from basic budgeting confusion to confident financial planning. Join the September 2025 cohort and build lasting money management skills.

Why Traditional Budgeting Fails

Most people try budgeting apps or spreadsheet templates, get frustrated after two weeks, then give up completely. We've seen this pattern hundreds of times.

Our program addresses the real problem: you need practical skills, not just another tracking tool. We focus on building sustainable habits that actually work with your lifestyle.

Each module builds on the previous one. By month three, you'll have systems that run themselves. No more guessing where your money went or panicking about unexpected expenses.

Six-Month Learning Journey

Each month focuses on one core skill. We move slowly enough that concepts stick, but fast enough to maintain momentum and see real progress.

Foundation: Know Your Numbers

Track spending without judgment. Most people discover they're spending 30% more than they thought. We'll set up simple systems and identify your personal spending patterns. No complicated categories or overwhelming detail.

Smart Allocation: The 60/20/20 Method

Learn our simplified budgeting approach that actually works long-term. Allocate income across essentials, savings, and flexibility. We'll customize this framework for your specific situation and income level.

Emergency Buffer: Sleep Better at Night

Build your safety net systematically. We'll calculate your ideal emergency fund size and create a realistic timeline to reach it. Plus strategies for handling financial surprises while you're building up.

Debt Strategy: Clear Path Forward

Tackle debt strategically using proven methods. Compare avalanche vs snowball approaches for your situation. Create payment plans that fit your budget while maintaining motivation through visible progress.

Future Planning: Beyond Survival Mode

Start investing and planning for bigger goals. Understand risk tolerance, time horizons, and how much complexity you actually need. Focus on sustainable strategies rather than get-rich-quick schemes.

Maintenance: Systems That Last

Build review habits and adjust systems as life changes. Learn to recognize when your financial plan needs updates and how to make changes without starting over from scratch.

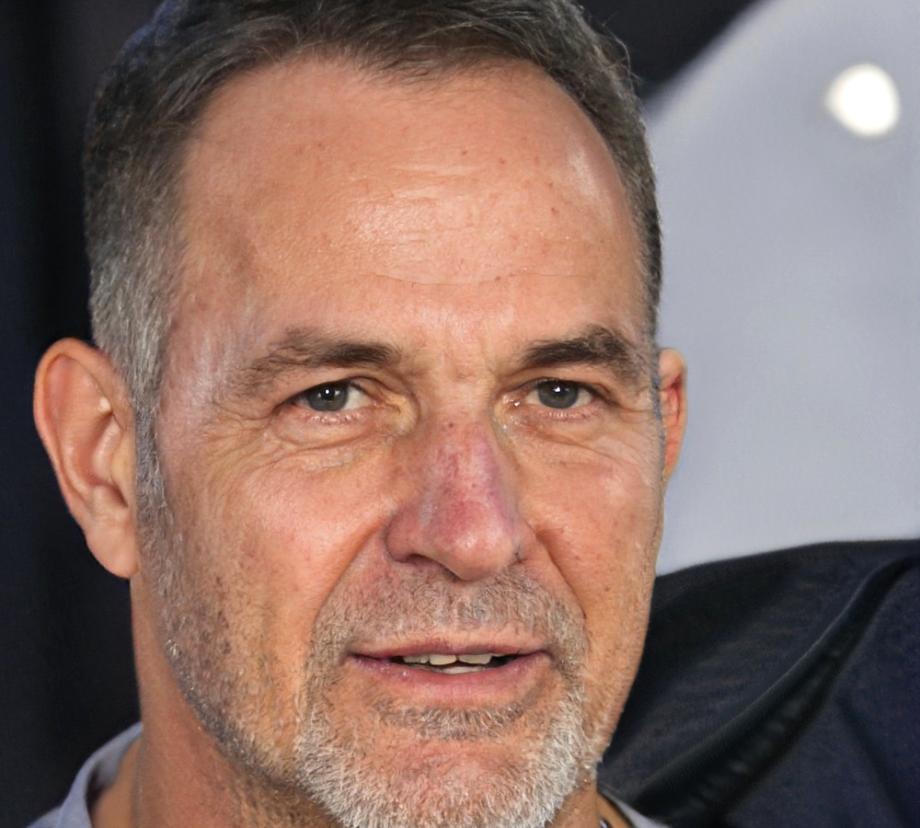

Radhesh Kumari

Lead Financial Educator

Former bank lending officer turned educator. Radhesh has guided over 800 individuals through financial planning challenges since 2019.

Personal Guidance Throughout

This isn't a self-study course where you're left to figure things out alone. Each participant gets individual attention and personalized feedback.

- Monthly group sessions with Q&A time

- Review your actual budget with instructor feedback

- Email support for specific questions

- Peer discussion groups for motivation

- Lifetime access to updated materials

We've found that people succeed when they have both structure and support. The curriculum provides the roadmap, but having someone to check in with makes all the difference.

Trishla Vanya

Planning Specialist

Certified financial planner specializing in household budgeting systems. Trishla focuses on practical implementation strategies.

September 2025 Enrollment

We limit each cohort to 25 participants to ensure everyone gets individual attention. Registration opens June 2025, with the program starting September 2025.